The United States is projected to increase beef imports from Australia, Brazil, and Uruguay by at least 50% in 2024 compared to 2023 levels. This surge is influenced by factors such as shifting supply and demand dynamics, the availability of lean grinding beef for burger chains, and the contrasting cattle cycles between the U.S. and Australia. While imports may meet consumer demand, risks to domestic cattle prices and rancher viability persist.

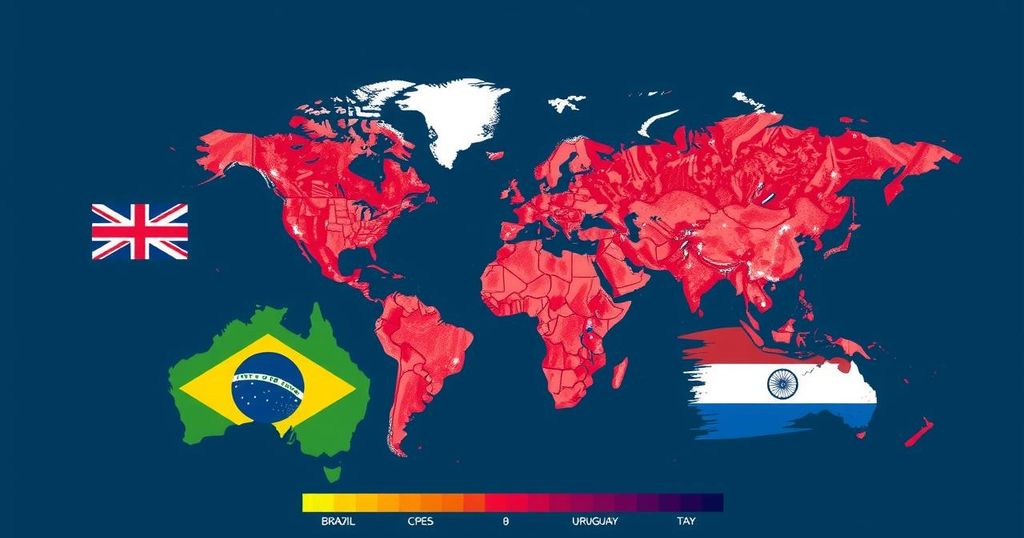

In 2024, the United States is set to increase its beef imports from Australia, Brazil, and Uruguay by at least 50 percent compared to 2023 levels, according to data from the United States Department of Agriculture (USDA). Analysts from the Chicago Mercantile Exchange indicate that Australia is expected to ship 64 percent more beef, while Brazil and Uruguay anticipate increases of 50 percent and 57 percent, respectively. The beef being imported is primarily lean grind or grinding beef, which is typically shipped frozen. The last time the U.S. imported such substantial amounts of beef from Australia was a decade ago. Eric Nelson, a cattle feeder from Iowa and a director at R-CALF USA, warns that increased imports could place downward pressure on domestic cattle prices, particularly affecting the value of cull cows, which are a critical income source for many cattle producers. According to Mr. Nelson, “For people whose income solely comes from cattle, they get paid twice a year – once for their calves and once for their cull cows. The price of those cull cows is important.” The rise in imported beef is partly linked to burger chains’ demands and the availability of additional fat from slaughter cattle. This current import scenario mirrors that of 2015 when domestic carcass weights were considerably high, suggesting a shift in market dynamics. Kalo also points out that the cattle cycle in the U.S. contrasts with that in Australia, where a rebuilding of the herd leads to increased beef production, while the U.S. faces a reduction in cowherd. Regarding trade agreements, there are currently no tariffs on Australian beef due to a Free Trade Agreement, while beef imported from Brazil and other countries incurs tariffs, potentially influencing market behaviors. Notably, Brazil’s fresh beef imports to the U.S. were restricted until recently, and now the influx appears to be stable despite the existing tariffs. In terms of the U.S. market, consumers have shown readiness to absorb higher beef prices. Nonetheless, there is a concern expressed by Nelson regarding the long-term implications of relying heavily on imports for beef supply, warning that diminished domestic production capabilities could lead to a reliance on corporate entities for meat supply, ultimately affecting consumer choice and industry vitality. The analysis also highlights that Canadian beef imports have remained stable, while feeder cattle imports from Mexico surged 32 percent, making significant contributions to U.S. feedlot placements within recent months. Observers note that Mexican feeder cattle do not directly compete with U.S. calves, as their adaptability to northern climates is limited. Still, they exert influence on U.S. cattle prices, which are currently pressured by both foreign imports and domestic supply dynamics. Furthermore, dynamics such as tariffs and international price fluctuations affect market access and stability, indicating that while trade may result in short-term benefits for certain stakeholders, it presents challenges for domestic producers. According to Mr. Nelson, the focus should be on maintaining a robust domestic industry capable of meeting national food supply needs.

The increasing trend of beef imports into the United States from countries such as Australia, Brazil, and Uruguay signifies a notable shift in the cattle market. The factors contributing to this trend include changes in international trade agreements, fluctuations in domestic cowherds, and evolving market demands from industries such as fast-food chains. The interplay between domestic production and international sourcing reflects the complexities of the global beef market, where supply and demand dictate prices and availability. Additionally, trade tariffs and agricultural policies play significant roles in shaping the competitive landscape for U.S. cattle producers. As the demand for lean beef rises, the U.S. must navigate a market that simultaneously seeks cost-effective imports and strives to support local ranchers and producers. This dynamic ultimately raises important questions concerning food security, economic viability for ranchers, and the long-term implications of relying on foreign beef suppliers versus fostering a robust domestic cattle industry.

In summary, the anticipated increase in U.S. beef imports from Australia, Brazil, and Uruguay highlights significant market shifts influenced by domestic and international factors, including trade agreements and cycles in cattle production. While these imports may help meet consumer demand, they may simultaneously challenge local cattle producers by affecting prices and market dynamics. Stakeholders in the industry must consider the balance between accommodating foreign beef supply and sustaining a viable domestic cattle sector to ensure long-term food security and economic stability for American ranchers.

Original Source: www.tsln.com